In this article, we have featured Jim Simons Net Worth in 2024

Summary:

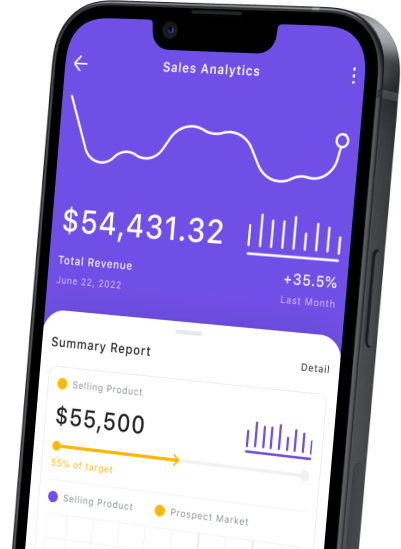

Jim Simons established Renaissance Technologies, a prestigious quantitative trading hedge fund business that currently oversees over $55 billion in assets. Simons is the firm’s founder.

He started Renaissance Technologies in 1982 and retired in 2010, although he is still involved with the company in some capacity and benefits financially from its finances.

Medallion Fund is a $10 billion black-box investment technique that is solely available to shareholders and staff of Renaissance Technologies. This approach has made Renaissance Technologies renowned.

To date, Simons has contributed $2.75 billion to various charitable organizations. Math for America receives the majority of its funding from his charity. Additionally, he is a supporter of research into autism.

In September 2021, executives from Renaissance came to an agreement with the Internal Revenue Service (IRS) to pay $7 billion in order to settle a tax dispute regarding trades made by the Medallion Fund.

Jim Simons Net Worth

Jim Simons’s net worth of $29 billion placed him at position 48 on the list of American billionaires maintained by Forbes in the year 2022.

In 1994, Jim Simons and his wife, Marilyn Simons, established the Simons Foundation, to which he donated more than $2.7 billion from his own fortune. The Simons Foundation is committed to advancing knowledge in the fields of autism research, health care, and education.

In 2004, Simons established Math for America with the intention of motivating mathematics and science instructors to continue working in their current positions and improve their teaching talents.

What prompted Jim Simons to step down from his position with the Federal Government was it?

Jim Simons opposed the war in Vietnam and decided in 1968 to leave his post at the Institute for Defense Analyses as a result of his opposition to the war.

Career

His mathematical work has mostly concentrated on the geometry and topology of manifolds during the course of his career.

New evidence supporting Berger’s categorization of the holonomy groups of Riemannian manifolds was presented in his Ph.D. thesis, which he wrote at Berkeley in 1962 under the direction of Bertram Kostant.

After that, he began to collaborate with Shing-Shen Chern on the theory of characteristic classes.

Together, they made the breakthrough discovery of the Chern-Simons secondary characteristic classes of 3-manifolds. These classes are connected to the Yang-Mills functional on 4-manifolds and have had an impact on contemporary physics.

Simons began his service with the National Security Agency in 1964, at which time he broke codes.

Between the years 1964 and 1968, he worked as a member of the research team of the Institute for Defense Analyses’ Communications Research Division.

In addition to teaching at Harvard University and the Massachusetts Institute of Technology, he also taught mathematics.

More than twenty years ago, Renaissance Technologies’ hedge funds began employing mathematical models to assess and execute deals, the majority of which were carried out automatically.

These hedge funds operate in markets all over the world. When trying to forecast the movement of prices in financial instruments, Renaissance relies on computer-based models.

Since its founding in 1988, the primary fund known as Medallion, which does not accept investments from outside parties, has realized trading gains totaling more than one hundred billion dollars.

It is anticipated that Jim Simons’s net worth will reach $22 billion by the month of July 2022.

Where Can One Find Documentation of Jim Simons’ Strategies?

In the book titled “The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution,” written by Gregory Zuckerman, Simons and his strategies for investing are discussed in detail.

What exactly is the “Black Box” strategy that the Medallion Fund employs?

The “black box” process is mysterious to those who are not involved. It has been asserted that the programmers who are responsible for the algorithmic trading program used by the Medallion Fund are ignorant of the reasoning that is utilized by the computer when it executes transactions.

Also, Read:

- Jensen Huang Net Worth | Career, Cars, Income

- Larry Page Net Worth | Salary, Cars, House, Income

- Neil Patel Net Worth : His Life Lessons and Journey

Conclusion: Jim Simons Net Worth

Jim Simons was the first person to use the use of quantitative analysis in the management of hedge funds. The tactics that Simons uses may be seen in the achievements of his company, Renaissance Technologies, and the Medallion Fund it manages.

Simons is known for his work in the fields of mathematics and investing.

Net Worth details: Jim Simons has made the majority of his fortune via Renaissance Technologies’ Medallion fund, from which he has acquired at least $9.5 billion over the course of his career.

He personally controls around $1.4 billion of the fund’s total $9 billion assets. According to the records, Simons is the owner of roughly 25 percent of the business, which is now estimated to be worth over $2.8 billion.

He established the New York-based hedge fund, Medallion, which has generated annual returns of more than 40 percent since its inception in 1988.