Personal loans are a great way for people to cover large expenses, manage debt or pay off bills.

If you’re an affiliate marketer, there are several excellent personal loan affiliate programs available that offer generous rewards and incentives for successful referrals.

In this guide, we’ll take a look at the best personal loan affiliate programs and how you can get started in earning commissions today.

Table of Contents

What Are Personal Loan Affiliate Programs?

Personal Loan Affiliate Programs are programs that allow affiliates to earn a commission for referring customers to lenders who offer unsecured personal loans.

An affiliate can refer potential customers through online or offline marketing channels, such as online ads, email campaigns, and word-of-mouth referrals.

The affiliate earns a commission from the lender when the customer is approved for a loan and makes their first payment.

These programs are often attractive to those in search of an additional stream of income because they require relatively little effort on the part of the affiliate while providing access to gainful opportunities.

Additionally, personal loan affiliate programs often come with no up-front costs or risks–the only investment required is time and creative energy.

Furthermore, affiliates can capitalize on their existing relationships with customers and prospects to create a steady stream of referrals.

Affiliates who bother to do their research into the best programs can benefit from higher commission rates, bonuses for quality referrals, access to exclusive offers, and more detailed reporting tools that can help them better track performance.

By taking the time to find an affiliate program that meets their needs and expectations, affiliates can maximize their potential earnings.

Personal loan affiliate programs are a great opportunity for those looking to make extra money or even launch a full-time career.

With the right mix of effort and creativity, it’s possible to earn substantial passive income from these kinds of programs — if you know what you’re doing.

25 Best Personal Loan Affiliate Programs 2024

The Best Affiliate Programs for Personal Loans are Listed Here.

1. Credible:

Credible is an online marketplace that connects borrowers to lenders and loan providers.

It makes it easy for borrowers to compare loan offers from multiple lenders, making sure they get the best deal possible.

The platform also provides helpful tools and resources like credit score tracking and budgeting advice.

Credible’s ultimate goal is to make the borrowing process as transparent, efficient, and stress-free as possible.

They strive to help borrowers save time, money, and frustration when finding the right loan for their needs.

With Credible, you can find confidence in every part of your financial journey.

By using Credible’s comparison technology, you can easily navigate the world of personal loans so you can worry less about financing your future endeavors.

You will have access to the best rates and terms available from leading lenders, giving you more options to choose from.

Credible also provides education and guidance throughout the loan process, so you can feel secure knowing that you’re making an informed decision.

With Credible, you can find the right loan for your needs quickly, easily, and confidently. Start exploring all of the possibilities today!

Duration of Cookies: 45 Days

Rate of Commission: $240 Per Sale

2. SoFi:

SoFi (short for Social Finance) is a financial services company that provides personal loan products, including student loan refinancing, mortgages, and banking.

Founded in 2011 by three Stanford University alumni, SoFi offers digital tools and services to help people achieve financial independence.

The company also offers wealth management services like investment advice and retirement planning. SoFi has become a leader in online lending providing loans to thousands of members in the US and beyond.

Their mission is to help people reach their goals with innovative financial products and services that enable access to credit, savings, home ownership, and more.

With automated processes and low overhead costs, SoFi can offer lower interest rates than traditional lenders.

By helping borrowers save money on interest payments, SoFi has become a popular alternative to traditional lending institutions.

SoFi has raised over $3 billion in capital commitments since launching and has helped nearly half a million members reach their financial goals.

With their commitment to customer service, SoFi is helping individuals take control of their finances and create better futures for themselves.

Duration of Cookies: 30 Days

Rate of Commission: $100 – $150 Per Lead

3. American Express:

American Express is an American financial services corporation that provides credit cards, charge cards, and traveler’s cheques to customers worldwide.

Founded in 1850 as an express mail business, it is one of the 30 components of the Dow Jones Industrial Average and a component of the S&P 500.

It has operations in over 130 countries and territories around the world.

The company was founded by Henry Wells, William Fargo, and John Butterfield, who developed a nationwide express delivery service via horse-and-wagon routes between New York City and Buffalo, New York.

Today, American Express offers products such as credit cards, charge cards, prepaid debit cards, travel insurance policies, and rewards programs for customers who use its services.

Its loyalty program allows customers to earn points when they use their cards and redeem them for rewards such as cash back, travel rewards, and merchandise.

American Express also has partnerships with restaurants, hotels, retailers, airlines, and other businesses that offer promotional deals and discounts to customers who use its services.

The company is a major player in the financial services industry, providing banking services such as mortgages, credit lines, auto loans, student loans, and business financing.

Duration of Cookies: 7 Days

Rate of Commission: Up to $200 Per Sale

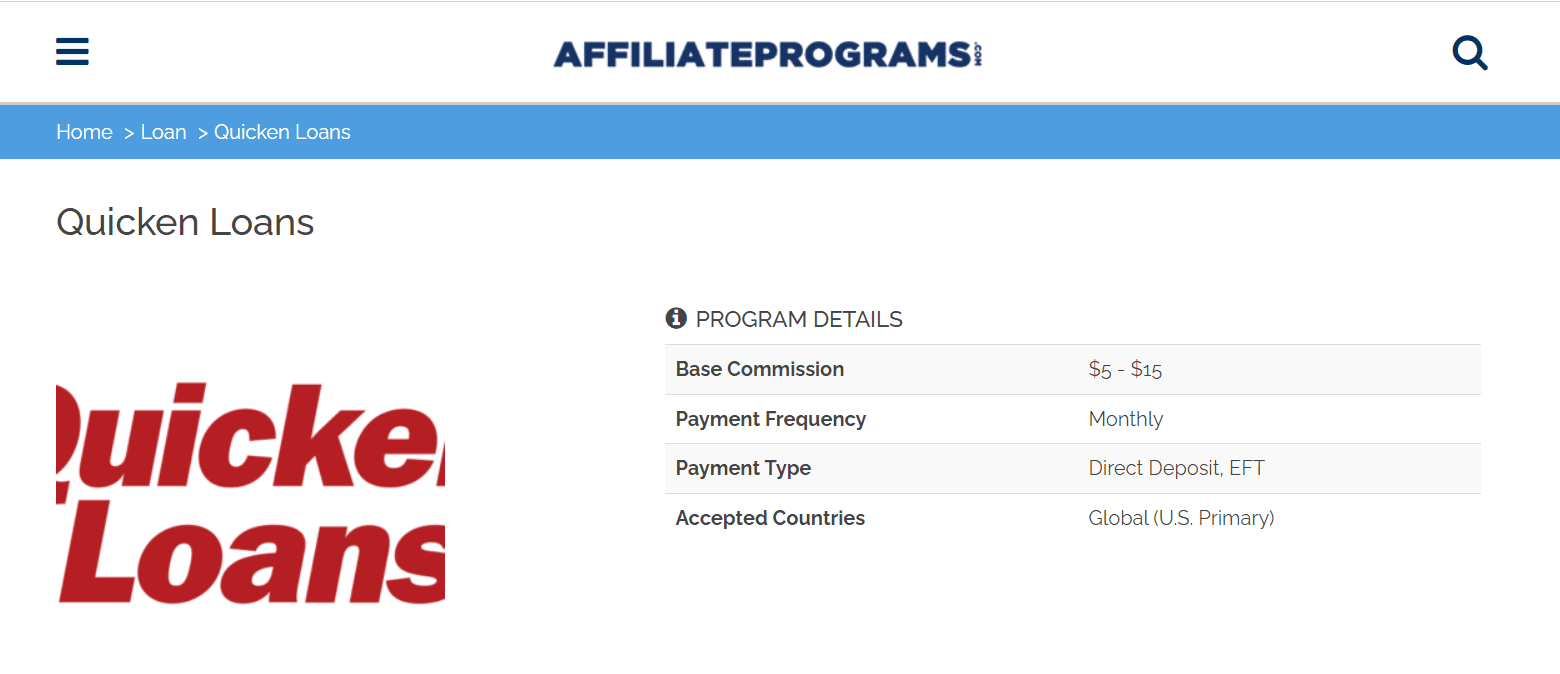

4. Quicken Loans:

Quicken Loans is a retail mortgage lender that provides various loan products to home buyers and current homeowners.

The company was founded in 1985 and is headquartered in Detroit, Michigan.

Quicken Loans offers customers a suite of services to streamline the homebuying process, from pre-approval to closing.

In addition to mortgages, Quicken also provides access to home equity lines of credit and refinancing options for existing homeowners.

With its cutting-edge technology and customer service team, Quicken Loans has become one of the nation’s largest mortgage lenders.

Customers can take advantage of competitive interest rates, low down payment requirements, and extensive customer support throughout the entire loan process.

By utilizing Quicken’s online platform, borrowers are able to easily navigate the loan process and find the best home loan solution for their financial situation.

Quicken Loans is committed to providing an accessible, secure experience for all its customers.

Duration of Cookies: 90 Days

Rate of Commission: $15 – $20 Per Lead

5. Fairstone Canada Personal Loans:

Fairstone Canada Personal Loans is a consumer loan provider that offers Canadians access to cash for things like debt consolidation, home renovations, or other big-ticket items.

It provides loans with terms of up to five years and flexible payment options. Fairstone Canada also offers the convenience of online applications and same-day loan approvals.

With its easy application process, competitive interest rates, and excellent customer service, Fairstone Canada is an ideal option for those seeking financial assistance.

Whether you’re looking to consolidate debt or make a major purchase, Fairstone’s convenient personal loan solutions can help you get the funds you need quickly and easily.

Plus, as an added benefit, customers who apply for a loan through Fairstone are eligible for additional credit reporting services that help you keep track of their credit rating.

Duration of Cookies: 30 Days

Rate of Commission: $21 Per Lead

6. American Express Canada:

American Express Canada is a leading financial service provider in the country.

It offers a wide range of products and services to its customers, including credit cards, travel services, insurance, and merchant services.

The company also provides loyalty programs such as My American Express Rewards and American Express Invites.

With a strong focus on customer service and innovation, American Express Canada has become one of the most trusted brands in the Canadian financial industry.

Its commitment to providing quality products and services has earned it numerous awards from organizations like J.D. Power & Associates.

With its secure online system for customers to easily manage their accounts, American Express Canada is dedicated to enhancing customer satisfaction through convenience and reliability.

The company’s commitment to its customers makes it an ideal choice for those looking to get the most out of their financial investments.

Duration of Cookies: 7 Days

Rate of Commission: $200 Per Sale

7. Credit Sesame:

Credit Sesame is an online platform that helps users manage their credit and finances.

It offers a variety of tools, such as free credit scores, personalized financial advice, and debt management plans.

The platform also provides users with access to discounts on products and services based on their financial situation.

Credit Sesame is committed to helping its members get the most out of their finances and build healthier financial futures.

With its comprehensive suite of features, Credit Sesame can help users take control of their money and make smarter decisions about how to use it.

Users may also benefit from having access to exclusive offers and deals available only through the platform, so they can save even more money while improving their credit scores and overall financial health.

With Credit Sesame’s suite of services and products, users can easily stay on top of their finances and make smarter decisions.

They may also benefit from the ability to access exclusive offers and discounts available only through the platform, so they can get even more value for their money spent.

Credit Sesame is dedicated to helping its members get the most out of their finances, build healthier financial futures, and save money in the process.

Duration of Cookies: Unknown

Rate of Commission: Unknown

8. myAutoloan.com:

myAutoloan.com is an online car financing platform that offers customers the ability to get pre-approved auto loan offers from up to four lenders in minutes.

Through the myAutoloan.com marketplace, customers can easily compare and choose the best loan offer available to them, with no impact on their credit score.

The entire process of getting a loan is simplified through easy online forms, making it easier than ever before to secure financing for your next car purchase.

With competitive rates and flexible terms, myAutoloan.com makes it simple to find the right loan for you without sacrificing time spent researching different lenders or worrying about complicated paperwork.

Plus, you will have peace of mind knowing that you’re getting a great deal on your new car loan.

Duration of Cookies: 45 Days

Rate of Commission: $5 Per Sale

9. Upstart:

Upstart is an innovative online lending platform that offers fast and convenient personal loans.

As opposed to traditional banking systems, Upstart uses artificial intelligence and machine learning algorithms to evaluate borrowers’ creditworthiness.

Upstart assesses potential borrowers’ applications in minutes, making the process faster than ever before.

Additionally, their model considers factors such as educational background and job history to make more accurate predictions about a borrower’s ability to repay a loan.

This means that those with limited or bad credit may still be able to secure a loan with Upstart.

With competitive interest rates and personalized repayment plans, Upstart has made it easier than ever for borrowers to access the funds they need.

Whether a person needs to pay bills, complete an education, or start a business venture, Upstart can help them get the money they need.

With so many advantages of working with Upstart, it is no wonder that more and more people are turning to this innovative lending platform for their financial needs.

Duration of Cookies: 45 Days

Rate of Commission: $120 Per Sale

10. National Funding:

National Funding is an online lending platform that specializes in providing small businesses with access to financing options.

They offer a wide range of products, including business loans, lines of credit, merchant cash advances, invoice factoring, and more.

Their services are tailored to meet the unique needs of each business, ensuring they get the best possible financing solution for their situation.

Additionally, National Funding has no hidden fees or lengthy application process – making it easy and convenient to get quick funding when you need it most.

Whether you’re looking for short-term capital to cover immediate expenses or long-term investments to help your business grow, National Funding can provide the resources you need.

With competitive rates and flexible repayment terms, National Funding makes it easier than ever for entrepreneurs and small business owners to access the funds they need.

So if you’re looking for the perfect financing solution, look no further than National Funding. With their help, you can get the funds you need to take your business to the next level.

Duration of Cookies: 60 Days

Rate of Commission: 5% Per Sale

11. BBVA Bank:

The BBVA Bank is a financial services provider based in Spain and Latin America, founded in 1857.

With its presence in 33 countries, BBVA Group is one of the largest financial groups in the world, offering a wide range of products and services for individuals, businesses, and corporations.

Its core business lines are retail banking, private banking, corporate banking, investment banking, and asset management.

It offers an extensive range of retail banking products such as checking accounts and credit cards; private banking services such as investments, wealth planning, and private lending; commercial loans; equity investments; mortgages; insurance policies; asset management including mutual funds and structured finance products.

In addition to its wide array of services and offerings, BBVA also provides educational programs on personal finance, credit, and money management to help its customers make informed decisions.

With a strong commitment to social responsibility, BBVA is dedicated to creating greater economic opportunities for people in the communities where it operates.

Duration of Cookies: Direct Link (Session Only)

Rate of Commission: $85 Per Lead

12. PersonalLoans.com:

PersonalLoans.com is an online lending platform that connects borrowers with lenders from all over the country.

By completing a simple application, borrowers can quickly be approved for up to $35,000 in personal loan funds.

Funds are typically disbursed within one business day, making PersonalLoans.com an ideal choice for people who need quick access to money for unexpected expenses or debt consolidation.

The platform also offers competitive interest rates and flexible repayment terms so borrowers can customize their payments to fit their budgets.

With its streamlined process, easy-to-use interface, and fast turnaround time—PersonalLoans.com makes it easier than ever to obtain the funds you need when you need them most.

Plus, there’s no prepayment penalty when you pay off your loan early.

Duration of Cookies: Unknown

Rate of Commission: 76% Per Approved Loan

Also, You May Like This:

- 27 Best Fitness Affiliate Programs

- 25 Best High-Paying Affiliate Programs

- 14 Best Book Affiliate Programs

- 20 Best Travel Affiliate Programs

13. Lending Club:

The Lending Club is an online peer-to-peer lending platform that provides borrowers with access to unsecured personal loans.

By connecting individual lenders and borrowers, the platform enables individuals to borrow money directly from each other without relying on banks or traditional financial institutions.

The company serves both retail investors – those who wish to invest small amounts of capital in a wide range of loan types – as well as institutional investors, who can gain exposure to larger pools of loans.

Through its website, The Lending Club offers transparency into the process and allows users to review borrower profiles and browse detailed loan information before committing funds.

This increases the likelihood that investments will repay successfully, allowing investors to earn attractive returns through interest payments made by borrowers over time.

In this way, The Lending Club helps borrowers find the funds they need while providing investors with a reliable opportunity to generate returns.

Duration of Cookies: Unknown

Rate of Commission: $100 Per Referral

14. Lexington Law:

Lexington Law is one of the leading consumer law firms in North America.

The firm specializes in credit repair, helping individuals to obtain a fair and updated credit report by challenging items on their reports that are inaccurate, incomplete, or unverifiable.

Lexington Law can also assist with removing bankruptcies, judgments, late payments, query letters, and other negative items from your credit reports.

With over 25 years of experience, Lexington Law has helped thousands of clients improve their financial lives.

Their team of experienced attorneys has the knowledge and tools to provide legal counsel to help you resolve any issue related to your credit report.

With their free online dashboard, you can quickly access your credit reports from all three reporting bureaus (Equifax, Experian, and TransUnion) and check the status of any disputes.

Lexington Law also offers a variety of financial services, such as helping you to create a budget, reduce debt, and manage your money better.

Whether you’re trying to repair your credit or need help managing your finances, Lexington Law has the experience and expertise to help.

Their team of dedicated attorneys will work hard to ensure that you receive the best possible outcome for your credit situation.

Duration of Cookies: 30 Days

Rate of Commission: $65 Per Sale

15. Capital Bank:

Capital Bank is a large, national banking institution that provides financial services to individuals and businesses in the United States.

Founded in 1998, Capital Bank has been helping customers get ahead financially for more than twenty years.

The bank offers a wide range of products and services, including checking and savings accounts, mortgages, personal loans, business loans, investment options, and more.

With hundreds of branches across the country, Capital Bank provides convenient access to its services from coast-to-coast.

Customers can also manage their finances through an easy-to-use online platform or on the go with the mobile app.

Whether you’re looking to save money or grow capital investments, Capital Bank has the resources you need to succeed financially.

Duration of Cookies: 30 Days

Rate of Commission: $25 Per Sale

16. Lending Tree:

Lending Tree is an online loan marketplace that allows consumers to compare loan offers from a variety of lenders.

It gives borrowers the power to shop and compare rates, terms, and other factors before they make a decision on which lender to work with.

By providing detailed information about loans, Lending Tree helps borrowers make more informed decisions that save them time and money.

On top of this, users can also take advantage of exclusive discounts and promos offered by select lenders.

All in all, Lending Tree makes the process of finding the right loan easy and hassle-free.

With its comprehensive network of lenders and wide range of options, it’s no wonder why so many people turn to Lending Tree for their loan needs.

Lending Tree makes finding the perfect loan simple and straightforward.

From personal loans and home equity loans to auto financing and debt consolidation, Lending Tree has a variety of loan types for borrowers with different needs.

Users can compare interest rates, terms, and other factors from many lenders at once, allowing them to quickly find their best option.

With its online tools and dedicated customer support team, Lending Tree is an excellent choice for anyone looking for a hassle-free way to finance their next loan.

Duration of Cookies: 14 Days

Rate of Commission: $1 – $70 Per Lead

17. BadCreditLoans.com:

BadCreditLoans.com is an online marketplace that helps consumers with bad credit find loan options and financial resources.

The company gives consumers access to a wide variety of lenders that specialize in providing personal loans, auto loans, business loans, and other types of financing for those with less-than-perfect credit.

BadCreditLoans.com also provides educational information on how to manage finances responsibly and rebuild credit scores over time.

The website makes it fast and easy to apply for loans by partnering with multiple lenders around the country who can offer competitive rates and terms tailored to individual needs.

With BadCreditLoans.com, borrowers can compare their financing options without fear of being turned down based on their credit history or score.

This makes it easier for consumers to find the right loan for their specific situation.

Duration of Cookies: 45 Days

Rate of Commission: 76% Per Lead

18. CIT Bank:

CIT Bank is an online-only banking institution that offers savings, money market, and certificate of deposit (CD) accounts.

The bank was established in 2000 and is headquartered in Pasadena, California.

CIT Bank operates as a subsidiary of CIT Group Inc., which provides commercial banking services to small businesses, middle market companies, financial institutions, and real estate investors nationwide.

At CIT Bank, customers can open savings accounts with no minimum balance requirement or monthly service fee.

Savings accounts come with competitive interest rates that are tiered depending on the account balance.

Money Market accounts offer higher yields than regular savings accounts while still providing easy access to funds through check-writing privileges and ATM access.

CDs offer even higher yields but require customers to keep their funds locked in the account for a set period of time with early withdrawal penalties.

Duration of Cookies: 30 Days

Rate of Commission: $100 Per Order

19. Upgrade:

The upgrade is a financial technology company that enables customers to access credit and build their credit profiles.

It provides consumers with access to fair and transparent personal loans, credit cards, and home equity products that are tailored to fit individual needs.

The upgrade also works with lenders to provide potential borrowers with the most competitive rates available.

With Upgrade, customers can monitor their credit scores over time and make smarter financial decisions that will help them reach their long-term goals.

The Upgrade platform is easy to use, secure, and reliable – making it the perfect choice for anyone looking to manage their finances more effectively. Upgrade helps customers keep their finances on track and unlock the potential of their financial future.

Duration of Cookies: 30 Days

Rate of Commission: $40 – $160 Per Lead

20. Ally Invest:

Ally Invest is an online broker that provides investors with access to a wide range of financial products and services.

From stocks, bonds, and mutual funds to futures and options trading, Ally Invest gives traders the tools they need for success in the markets.

With competitive pricing and no hidden fees or commissions, Ally Invest makes it easy for both novice and experienced investors alike to track their investments.

The user-friendly platform helps investors stay on top of their portfolio performance while providing guidance from experienced professionals as needed.

Additionally, Ally Invest offers a variety of educational materials so users can learn more about investing strategies and develop their knowledge base.

With its easy-to-use interface and low-cost structure, Ally Invest is an excellent choice for anyone looking to invest in the markets.

Duration of Cookies: 45 Days

Rate of Commission: $25 – $50 Per Sale

21. Check Into Cash:

Check Into Cash is a financial services provider that specializes in short-term consumer loans, checks to cash, and other related money solutions.

Founded in 1993, the company offers services both online and through its extensive network of over 700 physical locations nationwide.

The company has provided millions of customers with convenient, secure access to their money when they need it most.

With its convenient locations, flexible payment plans, and fast approvals, Check Into Cash makes it easy for customers to get the cash they need quickly and without hassle.

From payday advances to installment loans, title loans to check cashing, Check Into Cash has options for everyone’s needs.

Whether you’re looking for help managing bills or an emergency loan to cover unexpected expenses, Check Into Cash is here to help.

With its commitment to providing excellent customer service and financial support, Check Into Cash is a reliable source for all of your money needs. Get started today and get the cash you need quickly and easily.

Duration of Cookies: 30 Days

Rate of Commission: $12 – $45 Per Item

22. LeadsZoom:

LeadsZoom is an all-in-one software platform that enables businesses to quickly and easily generate leads, manage customers, and grows their business.

It provides a suite of powerful tools that enable you to quickly create marketing campaigns, automate lead capture processes, track customer engagement, and more.

With LeadsZoom, businesses can focus on growing their sales pipelines and expanding their customer base faster than ever before.

By simplifying the process of lead generation and customer acquisition, LeadsZoom allows you to stay ahead of the competition while increasing profitability.

Leveraging its advanced features, such as segmentation targeting and automated workflow processes, makes it easier for businesses to hone in on the best leads for maximum return on investment (ROI).

With this powerful platform, your business can have the best of both worlds – staying ahead of the competition while driving customer growth.

By automating lead capture and managing customers in real time, LeadsZoom is the platform that will help you make the most out of every opportunity.

Duration of Cookies: 30 Days

Rate of Commission: $70 Per Order

23. CashAdvance.com:

CashAdvance.com is a financial services company that provides short-term, unsecured loans for individuals in need of quick access to cash.

CashAdvance.com’s loan products are designed to help bridge the gap between paychecks or other income sources and immediate expenses such as medical bills, auto repairs, emergency travel expenses, and more.

With fast approval times and an easy online application process, CashAdvance.com makes it simple for borrowers to get the money they need quickly and without hassle.

The company offers several products, including payday loans, installment loans, and lines of credit tailored to various financial situations.

Borrowers can apply online directly through the website or by phone with customer service representatives available 24/7 to answer questions and complete applications.

Once approved, CashAdvance.com deposits funds directly into the borrower’s account or sends a check by mail with no hidden fees or charges.

With competitive rates and straightforward repayment terms, CashAdvance.com is an ideal choice for individuals looking to get access to fast cash in times of financial need.

Duration of Cookies: 45 Days

Rate of Commission: $100 Per Order

24. The Motley Fool:

The Motley Fool is an investment advisor and financial services company.

Founded in 1993 by brothers David and Tom Gardner, Fool’s mission is to help individuals make better decisions with their money.

Through its website, newsletters, podcasts, radio shows, seminars, and more, the company provides investors with market insights and strategies on how to manage their portfolios.

In addition to providing investment advice, The Motley Fool also offers a range of products, such as stock recommendations and retirement planning tools.

For those just starting out in investing or for experienced professionals looking for extra guidance and information on markets worldwide, The Motley Fool is an invaluable resource.

With decades of experience behind them, the team at The Motley Fool can help you make smart choices about your money and where to invest it.

Whether you’re looking for a steady income or gearing up for retirement, The Motley Fool has the right tools and expertise to get you there.

With a commitment to financial education and sound investment principles, The Motley Fool is dedicated to helping individuals build their wealth over time.

Whatever your goals may be, The Motley Fool can help make them happen.

Duration of Cookies: 45 Days

Rate of Commission: $100 – $400 Per Lead

25. 1-800 AUTO YES:

1-800 AUTO YES is a national vehicle subscription service that makes car ownership more affordable and accessible.

With 1-800 AUTO YES, you can get a reliable car without any long-term commitment or upfront costs.

Instead of going through the hassle of buying or leasing a car, you can drive a vehicle for as long as you need it and pay only one low monthly fee.

You don’t have to worry about maintenance, insurance, roadside assistance, or depreciation because 1-800 AUTO YES covers all of these costs.

Plus, with flexible payment plans and no fixed contracts, you are free to upgrade your vehicle anytime.

Whether you need temporary wheels for business trips or want to try out different models before settling on the perfect car for you, 1-800 AUTO YES makes car ownership simple and convenient.

With 1-800 AUTO YES, you can hit the road with confidence, knowing that you are always covered.

Duration of Cookies: 45 Days

Rate of Commission: $12 Per Order

Quick Links:

- List of 20+ Best Recurring Affiliate Programs

- 16 Best Referral Programs To Make Money

- 32 Best Software Affiliate Programs

- Top 18 Best Gaming Affiliate Programs

- Top 10 Best Pay-Per-Click Affiliate Programs

- Top 14 Best Fashion Affiliate Programs

- Top 10 Best Canadian Affiliate Programs

Conclusion: Best Personal Loan Affiliate Programs 2024

The best personal loan affiliate programs offer attractive commission rates and bonuses, as well as dedicated support from experienced affiliates.

Whether you’re just getting started in the industry or have years of experience under your belt, these platforms can help you maximize your profits while delivering quality products and services to consumers worldwide.

With guidance on how to get started and comprehensive reviews of the top programs, you can now make an informed decision on which program is best for your affiliate marketing needs.